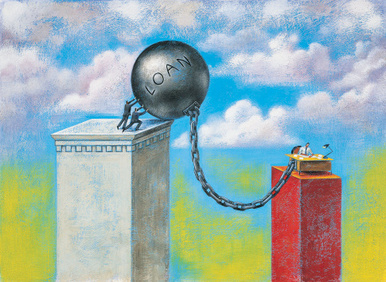

Despite talk of an economic recovery within the United States, the majority of people are not feeling the effects. Most of the recovery has occurred within Wall Street and the financial industry; the same people who caused the recession to begin with. As a result, average American families have continued to struggle making ends meet, often with crippling debt holding them back.

The debt management industry has found ways to try and assist as many families as possible. These firms have worked with the Internal Revenue Service and Congress to allow them to be able to help families in new ways and to deal with larger volumes of debt. Debt management firms have already helped tens of thousands of Americans to break free from the shackles of crippling financial debt. A debt management program works by working with creditors to reduce payment amounts, lower interest rates, reach settlements for pennies on the dollar, and even dismiss debt entirely. They are able to do it through negotiation processes not available to individual debtors. They use their size and expertise to help reduce and clear debt for families, regardless of amount, income, credit history, or credit score. Every family has the same access to debt management programs. For anyone seeking to get out from under massive debt, a debt management program may be available and appropriate. As with any purchase or endeavor, there are some companies that are head-and-shoulders above the competition. Be sure to do any homework to ensure the company is reputable and dependable. There are some companies that are not quite as honest in their dealings with debtors, but many of those companies have gone out of business or faced government intervention, including criminal charges. A quick online search of the company's reputation can often be enough. A call or visit to the Better Business Bureau can also help. The amount of relief a family is able to achieve depends on the company they work with, the type of debt, their ability to pay, and how much creditors are willing to help. No debt management firm can guarantee results.  Consumer loans have been around for many years, and each loan that is offered has its own perks and drawbacks. A consumer loan can be an unsecured loan or a secured loan. An unsecured loan means that there is no collateral required for loan approval. A secured loan means that some valuable item must be used as collateral to achieve the loan. There are two main distinctions between the two loans. The unsecured loans usually have higher interest rates, but the worst thing that can happen if you default on the loan is a reduced credit score. A secured loan comes with a lower interest rate, but if you default on that loan the item that you used for collateral can be lost to the loan company. There are many options available, so take the time to find the best one for your situation.

The more common consumer loans are personal loans, consolidation loans or home equity loans. Personal loans can usually be taken out for very small amounts, and most people will be able to extend that amount to at least $15,000. Some banks are willing to offer even more money based upon your credit worthiness. Consolidation loans are really becoming more popular each year as consumers continue to struggle paying off their debt. A consolidation loan can be used to pay off any unsecured debts that you may have. Once you are approved for the loan, you simply pay off the creditors. This is a great way to reduce the number of payments you have each month and possibly have a lower credit score. Consumers have found that home equity loans are another form of consumer loans with a low rate monthly rate. There may be some stipulations regarding the loan, but remember that this is money that is drawn against your home. It is essential to repay it as required by the terms of the agreement. |

RSS Feed

RSS Feed